Raising the state pension age to 71 would have “severe consequences” on the living standards of Britons in their 50s and younger, experts claim.

A think tank has proposed the state pension age, must rise to 71 by 2050, amid growing life expectancy and falling birthrates.

The UK state pension age is currently 66 and is expected to hit 67 between May 2026 and March 2028, with a further hike to 68 from 2044.

Critics are warning a hike to beyond 70 would add to the number of pensioners already suffering in poverty.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

A proposal has suggested the state pension age should be raised to 71

GETTY

Speaking exclusively to GB News, co-founder of Raisin UK Kevin Mountford said that while it would reduce state pension spending, it would have a devastating impact on many approaching retirement.

He explained: “Although this proposal could save costs, the reality is that it could have severe consequences for middle-aged people who may be required to work longer before claiming their pension.

“This change would particularly impact those currently in their early 50s and younger and would add to the number of pensioners already living in poverty, which is one in four.”

The finance expert said such an age increase would likely only benefit Britons in higher-income groups, who are less likely to be reliant on the state pension.

Ms Mountford highlighted statistics which show only the top 10 per cent of the UK’s population stay healthy into their early 70s.

He also warned raising the state pension age this drastically would be considered a betrayal by voters at any upcoming General Election.

Raisin UK’s co-founder added: “The suggested policy update is also inflexible due to its unique eligibility criteria for state pension, which is part of every worker’s social contract.

“Neither the NHS nor the UK labour market is prepared for this policy, too; the former faces significant health differences across the country, while the latter is rife with ageism.

Britons will have to work for longer to access their retirement entitlement

PA

“What’s very clear is that there isn’t a fix-all for the UK’s ageing population and we could see this issue becoming a political hot potato between parties as we get closer to a suggested general election.”

Currently, the full new state pension is paid at a weekly rate of £203.85 which will rise by 8.5 per cent in April under the triple lock.

It means the full new state pension will rise to £221.20 per week or £11,502.40 per year.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

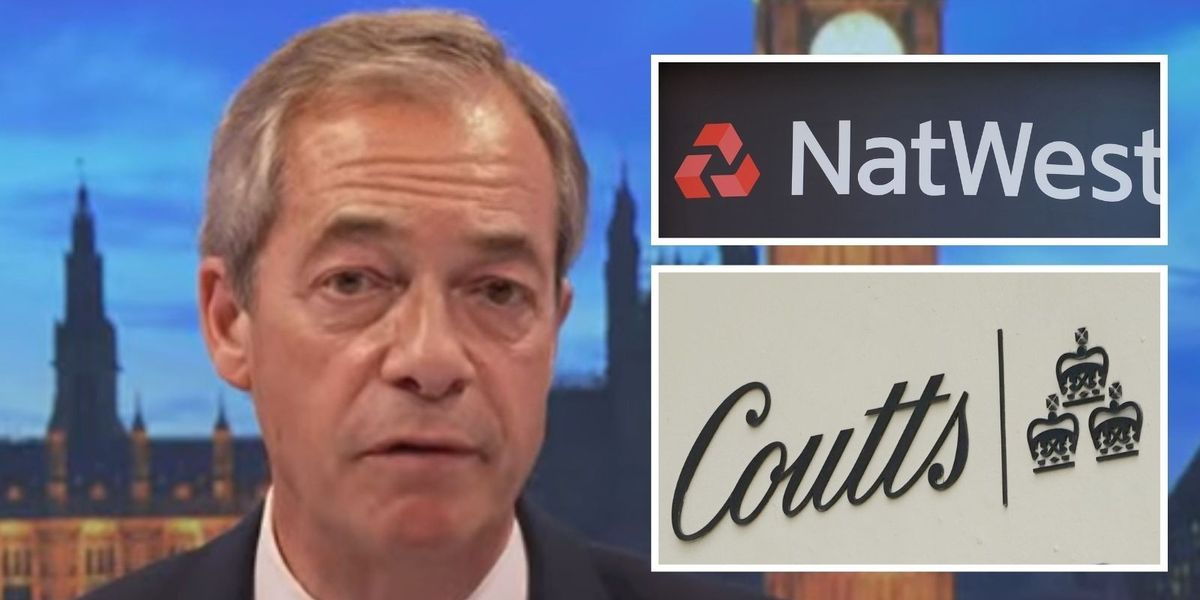

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession