It’s 2023, a year of recession, and the culpability for this recession must surely lie with the Bank of England.

Why ostriches? What are ostriches famous for? They bury their head in the sand.

They don’t listen to or learn from experience. They don’t see what is happening and act upon it. They hide from it.

What did happen? Well, during COVID there was excessive quantitative easing.

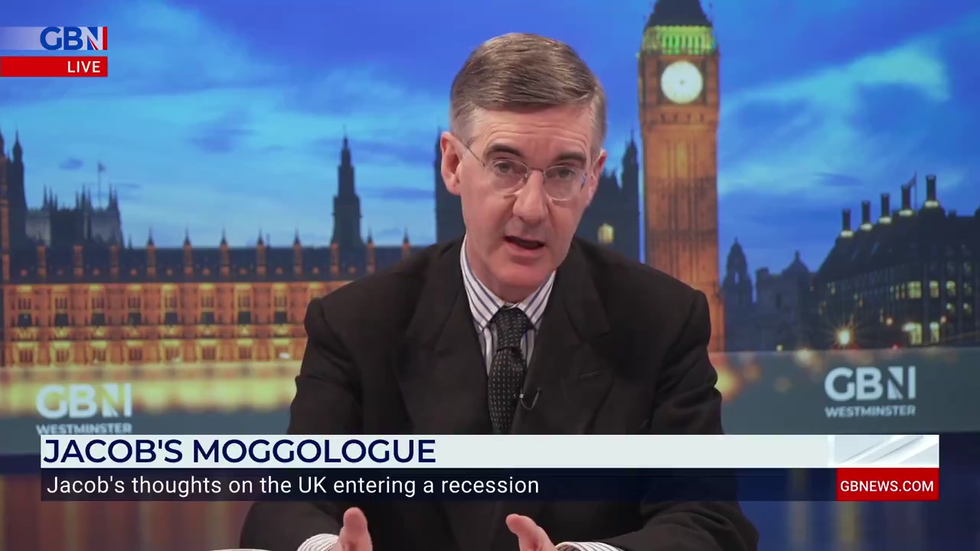

Jacob Rees-Mogg hit out at the Bank of England

GB NEWS

This went well beyond what was necessary when supply was short, that things weren’t getting through.

Goods weren’t getting into the UK because of complications with deliveries, and that inevitably meant that there was likely to be inflation.

Indeed, it was pointed out that inflation was likely to happen by people like John Redwood and Andy Haldane.

The Economist, the chief economist at the Bank of England, warned of inflation, but they ignored him and interest rates were increased too slowly.

Other countries started putting theirs up.

The Federal Reserve was faster to act, but the Bank of England didn’t.

The UK has entered a recession

GETTY

It was slothful, and that meant that inflation was worse than it needed to be. Indeed, if they hadn’t done final round of quantitative easing, inflation may not have been as bad altogether. But now it’s the reverse problem.

Having been slow to act in the first place, it’s now slow to react. It is cutting too slowly.

Interest rates ought already to be coming down because inflation is a lagging indicator.

What I mean by that, inflation happens after the event. So you have the monetary action QE or interest rate changes, and then inflation comes at some time later. It doesn’t happen in a synchronised fashion.

And that’s why it’s so important to look forward and estimate what may be about to happen before you make your changes. And that’s what the bank hasn’t done.

The governor is blaming this on poor data.

Well, that’s actually not a new criticism. In 1956, Howard McMillan said that it was like running the economy on last year’s Bradshaw.

Well, Bradshaw was the train railway timetable guide and it was saying that he was doing it on out of date information.

Jacob Rees-Mogg compared the Bank of England to an ostrich

All economic policy is done on out of date information. That’s the whole point.

That’s the job. And unfortunately the Treasury, the ABR, the Bank of England model doesn’t work and it’s stultifying policy making and it means that we’re not getting the right decisions through.

And this combines with the worrying rise in economic inactivity, the 9.3 million people who are economically inactive and that’s gone up by about a million.

We need to get people back into work and that’s partly by ensuring that the benefit system, which was doing a very good job from 2010 in the early years of the Conservative and coalition Government in getting people back to work.

We need to reemphasise that we also need dynamic economic policy.

We need the Government to be spending less to be wasting less.

We need civil servants back at work and we need to leave more money in your pocket.

We need the tax cuts that may help stimulate growth.

We also need interest rate cost cuts, but the ostriches may not be providing that immediately.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession