A cyclist rides past an electronic stock board showing a figure of the Nikkei Stock Average outside a securities firm in Tokyo, Japan, on Friday, Jan. 12, 2018.

Tomohiro Ohsumi | Bloomberg | Getty Images

Coincidence in the markets can mean nothing, or it can provide a very useful trading edge.

Looking at the below chart, you could be excused for thinking that was the Dow for the period from September 2017 to the current date. The behavioral characteristics are the same.

However, it’s the Nikkei 225 and it’s a spitting image of the Dow. Technically, we apply the same analysis and reach the same conclusions that we would apply to the Dow even though most people would argue that the fundamental, political and economic situations are very different.

The first similarity in behavior is the strong trend rise to a peak in January 2018. Then the market sold off very dramatically. The index dipped below the lower edge of the long-term group of averages in the Guppy Multiple Moving Average indicator.

That was followed by a rapid rebound and a period of sideways movement with a slight upward bias. In recent weeks, both indexes have rallied strongly and retested the highs.

It’s not only the pattern of behavior that is the same. The dates of the peak behavior are the same. However, the detail of the daily index behavior is different in the Nikkei and the Dow, so we cannot use one index as a leading indicator of what will happen in the next day or so in the other index.

The GMMA trend in the Dow is stronger than the Nikkei trend, so there is a little more risk in the Nikkei. Dow trend strength is shown with the long-term steady separation in the long-term GMMA. It’s confirmed by the behavior of the short-term GMMA, which has not dipped into the long-term GMMA. The Nikkei trend is more volatile with two substantial tests of the long-term GMMA in April and September 2017.

The most important conclusion from this similarity in behavior is that a continued breakout in the Dow will be replicated with a similar breakout behavior in the Nikkei. Applying the same trade band projection methods to the Nikkei gives an upside target near 26,300.

Of course, a Dow collapse would also be replicated by a Nikkei collapse. The risk comes in two ways. First, it’s important to know which index leads in terms of behavior. Logic would suggest it’s the larger market, the Dow, so Nikkei traders will watch the American index for advance indications of how the Nikkei may behave.

Second, this behavioral relationship tells us that holding open positions in the Dow and the Nikkei will not provide safety often attributed to portfolio diversification because of the high level of behavioral correlation.

Despite that, the Nikkei is the better trading opportunity with a higher level of volatility and, hence, leverage. Low-to-high for the Nikkei is 18 percent compared to a 13 percent return from the Dow for the same behavioral move. The Nikkei and the Dow may be joined at the hip when it comes to behavior, but the Nikkei is moving faster.

Daryl Guppy is a trader and author of Trend Trading, The 36 Strategies of the Chinese for Financial Traders, which can be found at www.guppytraders.com. He is a regular guest on CNBC Asia Squawk Box. He is a speaker at trading conferences in China, Asia, Australia and Europe. He is a special consultant to AxiCorp.

For more insight from CNBC contributors, follow @CNBCopinion on Twitter.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

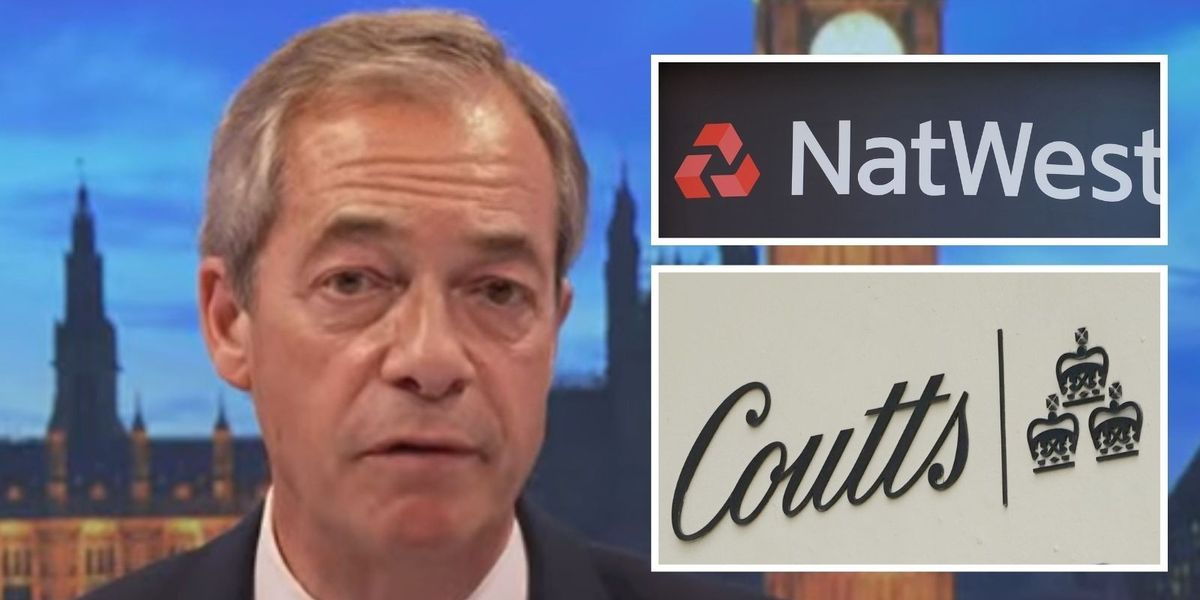

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession