Jeremy Hunt has insisted the Government’s plan to boost the economy is working – but that he wants to go further on making tax cuts.

Speaking to GB News Hunt said: “We always expected we would have weaker growth while we were tackling inflation at over 11 percent. It’s not possible for an economy to grow healthily or sustainably when you have that inflation and the only way you can really tackle that is with higher interest rates. And that is the right thing to do. Because families up and down the country really suffer with high inflation.

“It pushes up the cost of living, the cost of filling up a tank of petrol and energy bills go up. So we were right to do that. And, of course, this data is very challenging, but the underlying picture is that the battle against inflation is succeeding faster than many people thought.

“People thought that we weren’t going to get back down to 2 per cent for another year and it looks like we’ll do that in the next few months. And when that happens, if we stick to our guns, stick to this difficult, but correct course, what we will see is that the Bank of England is enabled to reduce interest rates. It will reduce the pressure on the economy, and we can start growing more healthily.”

On the growing calls for the need to see a cut on interest rates, Hunt said: “Our system rightly depends on the Bank of England. operating independently from politicians. So I don’t comment on their decisions. Because I don’t want a system where there could be any kind of political involvement in those interest rate decisions.

“What I will say is that the increases in interest rates that we’ve had, have succeeded in bringing down inflation from 11 per cent to 4 per cent. And we are now seeing, if you look at the debate inside the Monetary Policy Committee, increasing numbers thinking that the time may come sooner rather than later to bring down interest rates.

“But we must leave them to make that decision. What the independent forecasts in the market say is that within a matter of months, we could see interest rates starting to fall and I think that will give some encouragement

Pressed by GB News’ Liam Halligan on why he hadn’t done more to cut corporation tax he insisted: “Well, we had a situation in which we had to balance the books otherwise, the markets wouldn’t have confidence in the UK economy, our debt interest would have soared up and we’d have had even higher taxes.

“But I do agree with you 100 per cent and I have not changed my position that our future as a country is to have the most competitive business taxes in the world. And that’s why in the autumn statement, we cut corporation tax, we didn’t cut the headline rate but we did it through this thing called capital allowances.

“Let me tell you what I do for people who are self-employed. I abolished an entire class of national insurance. I reduced National Insurance for people self employed by 1 per cent. That’s an average reduction of £350 a year for someone who’s self-employed. So they are the lifeblood of the economy. We’re doing everything we can to support businesses. And yes, we do want to bring down taxes because we want to encourage investment in the economy.”

WATCH ABOVE.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

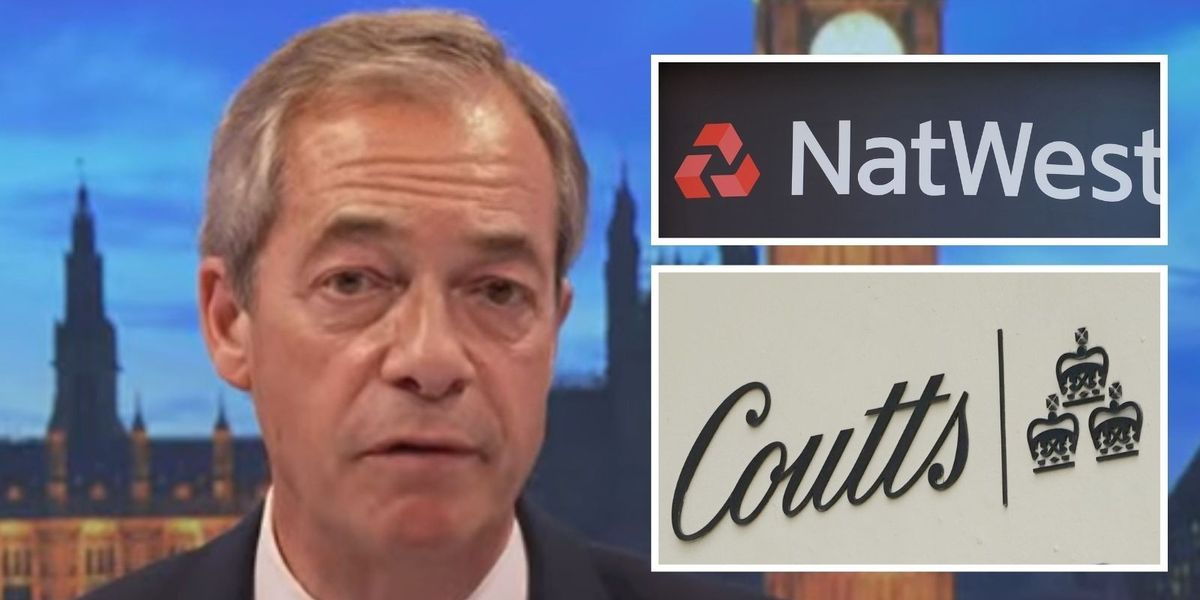

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession