Britons have lost an estimated £1,500 per person since the onset of the cost of living crisis, according to a leading think tank.

The Resolution Foundation warned that the UK economy has not experienced growth in two years following the news that the country fell into a recession late last year.

Figures from the Office for National Statistics (ONS) revealed that gross domestic product (GDP) contracted by 0.3 per cent in the last quarter of 2023.

A recession is defined as happening when a country experiences two consecutive quarters of negative growth with the UK technically meeting this definition.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The cost of living crisis has hit families hard in recent years

GETTY

Outside of during the Covid-19 pandemic, this is the first time the country has experienced a recession in 15 years.

Despite this being first non-pandemic recession in over a decade, households have struggled with ongoing rise in the cost of living.

This has been exacerbated by inflation-hiked prices and fluctuating energy costs, as well as the Bank of England’s intervention over interest rates.

Research carried out by the Resolution Foundation has determined the average person has lost £1,500 on average since the beginning of the cost of living crisis.

James Smith, the think tank’s research director, described the UK as a “stagnation nation” with there being “few signs” of improvement in the foreseeable future.

He explained: “Britain has fallen into recession, and a far deeper living standards downturn. Even this weak data is flattered by a rising population.

“After accounting for population growth, the UK economy hasn’t grown since early 2022, and fallen far behind its pre-cost of living crisis path, with an equivalent loss of around £1,500 per person.

“The big picture is that Britain remains a stagnation nation, and that there are precious few signs of a recovery that will get the economy out of it.”

Soaring energy bills have been an ongoing issue for families GETTY

Soaring energy bills have been an ongoing issue for families GETTY

The Government has pushed blame on yesterday’s recession news on the Bank of England’s decision to raise the base rate over the past year. However, Iain McLeod, head of private client consultancy at St. James’s Place, believes this is an inaccurate assessment.

Mr McLeod said: “During previous periods of recession, central banks have often lowered interest rates in order to stimulate demand in the economy and help to return to economic growth.

“Whilst rate cuts are still forecast in 2024 by many economists, this cannot be completely relied upon – as higher interest rates is the main weapon in the war against inflation, which has proved very persistent.

“Similarly, previous periods of recession have led to falling oil and gas prices – however with the ongoing war in Ukraine and tensions in the Middle East, this cannot be relied upon either. It would be prudent to allow for of period of higher household bills given the ongoing uncertainty.”

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

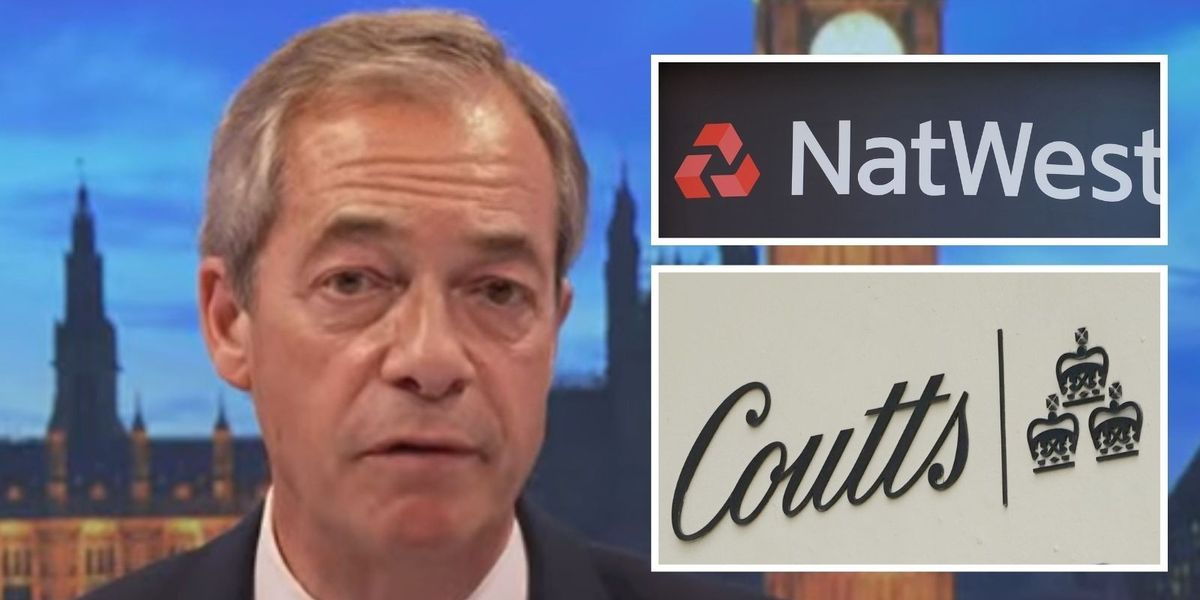

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession