A woman walks at the Bund in front of the financial district of Pudong in Shanghai, China.

Aly Song | Reuters

The Shanghai index retreated and then broke out this month, and that’s a bullish signal for the market.

The pattern confirms that the rally from the low of 2,691 is part of an emerging consolidation and breakout.

Given that, the immediate upside target is the value of the lower edge of the long-term group of averages in the Guppy Multiple Moving Average indicator. The second resistance level is the value of the upper edge of the long-term GMMA.

It’s too early to call for a trend reversal, but the pattern of development suggests such a move is underway.

Investors watch for the development of a series of rebound rallies to confirm that the momentum of the downtrend has slowed. The recent rally and retreat has some of the characteristics of a consolidation pattern, and that’s tested by the behavior of the index as it moves around resistance near 2,820. Breaking out above that level is bullish.

Investors continue to watch for two features to confirm a trend change.

The first is the appearance of more days when the index rises. If the structure of the market changes and the up-days move more easily and have larger daily ranges, then that confirms confidence is slowly returning to the market.

The second featured that investors are watching is the behavior of the index’s GMMA. The indicator captures the inferred behavior of investors and traders. Compression shows agreement about price and value, but agreement does not last for long in the market, so that also signals a potential for a trend change.

The short-term group of averages has compressed and turned up, which confirms a return of confidence for traders. The long-term group of averages is well separated, showing that investors are still sellers. The downtrend has not ended, but the process of a trend reversal is developing.

The degree of separation between the two groups of averages is slowly narrowing, which is a precondition for a change in the trend direction. It’s not a signal of a strong or sudden trend reversal, but it shows downtrend pressure is reducing.

Aggressive traders are starting to enter the Shanghai market in anticipation of a trend change. Conservative traders will wait for a move in the longer-term GMMA.

Daryl Guppy is a trader and author of Trend Trading, The 36 Strategies of the Chinese for Financial Traders, which can be found at www.guppytraders.com. He is a regular guest on CNBC Asia Squawk Box. He is a speaker at trading conferences in China, Asia, Australia and Europe. He is a special consultant to AxiCorp.

For more insight from CNBC contributors, follow @CNBCopinion on Twitter.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

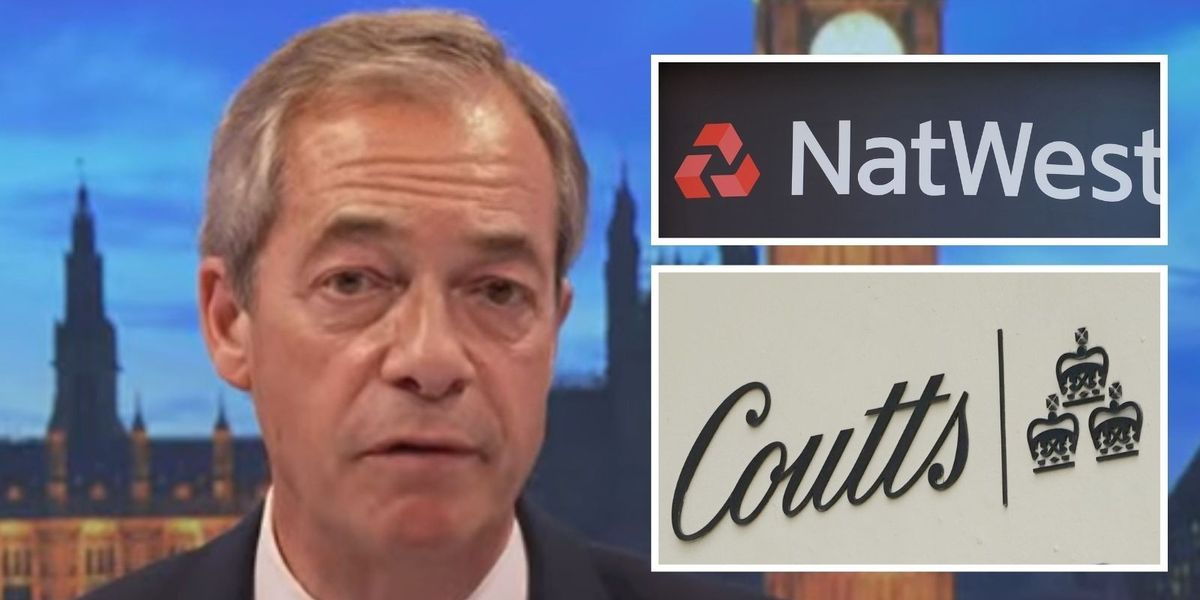

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession