The Australian dollar in various denominations.

Brendon Thorne | Bloomberg | Getty Images

The Australian dollar challenged a long-term resistance level near 81 and then failed to develop a new uptrend. The retreat took the Australian dollar back to test the long-term support level near 7.75.

Australian exemption from the new U.S. steel tariffs had caused a new jump in the currency and raised the question of whether the Australian dollar could break above the long-term resistance level near 81.

A breakout above the upper edge of a long-term trading band has the potential to test 84.5.

The situation is a little more bullish than it was in January 2018 when the Australian dollar last tested the 81 level of resistance. These bullish features include a successful test and rebound from the support level near 77.5 and a continuation of the uptrend behavior supported by the long term Guppy Multiple Moving Average indicators.

The bullish features include the placement of a new uptrend line starting from the low near 71 in December 2016.

The breakout target near 84.5 is a technical target based on the trading band projection. This level has no previous history of support or resistance so this leaves open the potential for the Australian dollar to move above this technical target.

The long trading band at the 77.5 level was established in April 2016 and tested many times as a resistance level. This increases its importance as a support level when the Australian dollar moved above 77.5 to the new resistance level near 81.

The resistance level had its third test in six months in January 2018 before a retreat developed. The new rally will retest 81 as a resistance level.

The frequent previous tests increases the probability that the Aussie dollar can break above resistance. A breakout above this level has a significant impact on Australian interest rates with the Reserve Bank of Australia even more reluctant to increase interest rates when the Australian dollar is strong.

The width of the trading band between 78.5 and 81 is projected upwards to set a target near 84.5. This target is treated with caution and used as a guide only because these price projection methods are not quite as reliable as they are with index and equity charts.

We use the GMMA indicator analysis to identify trend strength and trend changes. Full trend confirmation comes when the short-term GMMA moves completely above the upper edge of the trading band. This is the key indicator and we use the ANTSSYS trade and analysis method to identify the opportunities as the rally continues.

The longer term outlook for the Australian dollar remains bullish.

Daryl Guppy is a trader and author of Trend Trading, The 36 Strategies of the Chinese for Financial Traders, which can be found at www.guppytraders.com. He is a regular guest on CNBC Asia Squawk Box. He is a speaker at trading conferences in China, Asia, Australia and Europe. He is a special consultant to AxiCorp.

For more insight from CNBC contributors, follow @CNBCopinion on Twitter.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

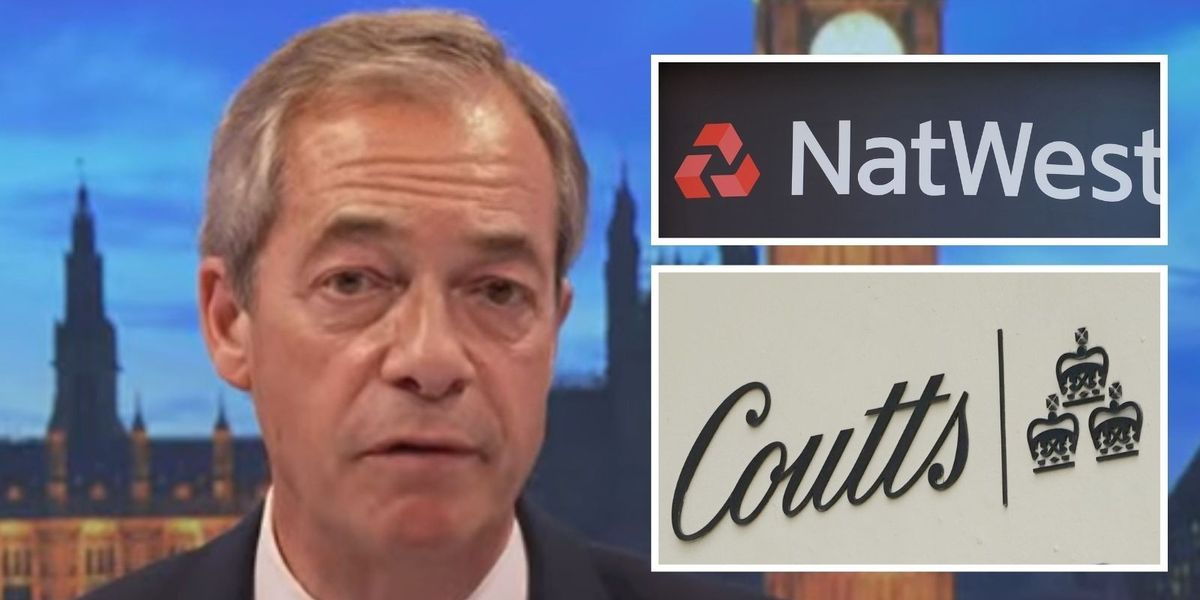

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession