Nationwide Building Society has withdrawn the eight per cent Flex Regular Saver account from sale, with savers now offered 6.5 per cent on their regular savings.

The new issue, paying 6.5 per cent AER/gross p.a for 12 months, is still in the top three market-leading accounts for regular savings, according to Moneyfactscompare.

Customers can save up to £200 per calendar month in this account.

It allows up to three withdrawals within 12 months after the account is opened.

The Flex Regular Saver is an online-only account and is available to Nationwide Building Society current account customers.

Customers, who must hold either a FlexPlus, FlexDirect, FlexAccount, FlexStudent, FlexGraduate, FlexBasic or FlexOne account, can only open one Flex Regular Saver. This can either be an individual or joint account.

Nationwide withdrew the previous issue at close of business on February 8, 2024.

The eight per cent interest rate for existing customers who opened the previous issue remains unchanged.

After the first 12 months, this account will revert to an instant access account.

The interest rate will drop to 2.15 per cent AER variable if four or more withdrawals are made during the 12 months.

Customers must be at least 16 years old to open a Flex Regular Saver.

Savers have been urged to act quickly recently, amid speculation the Bank of England could begin cutting the base rate later this year.

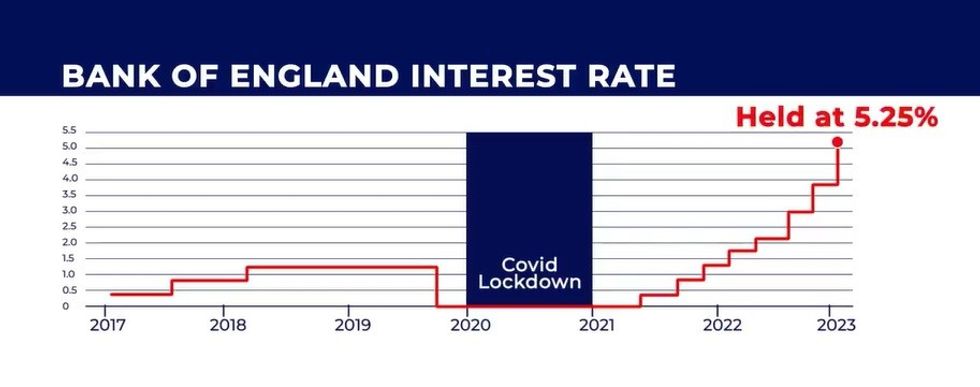

The Bank of England hiked interest rates 14 consecutive times before holding it at 5.25 per cent

GB NEWS

The central bank had hiked interest rates 14 consecutive times between December 2021 and August 2023 and has since held it at this level.

The base rate is currently at a 15-year high of 5.25 per cent.

Last week, Skipton Building Society launched a new savings account which it said was the “first-of-its-kind”.

The new Tracker Bond will track at the Bank of England base rate for two years. It means savers will find their interest rate goes up or down in line with the bank rate.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession