A heavy crude oil pump.

James Hall | EyeEm | Getty Images

A little over a month ago I wrote about NYMEX oil and suggested that the pullback was a buying opportunity. Investors watch for the opportunity to add to long positions as the price rebounds from any of the three support features on the oil price chart.

To date, the price has not rebounded. Does that analysis still hold as oil falls towards $65?

The short answer is “yes,” but with the repeated caveat that traders need to wait for evidence of a rebound before taking a long position. The analysis holds because the technical structure of the NYMEX oil market remains the same.

The fall below the long-term uptrend line is potentially bearish, but other features suggest the bear is not in command of the market. The future importance of the uptrend line is the way this will now act as a resistance level for future rallies.

Extending the line into the future suggests that it may be early 2019 before there is a serious challenge to the $76 price level. The extended line acts as a resistance level. That time frame changes if oil is able to move above the trend line and again use it as a support level.

The first support feature of the chart is the long-term support level near $65. That was the support base for the most recent strong rebound rally. That level is currently under test.

Oil has a well-established pattern of moving in trading bands around $11 wide. The current price activity is testing the lower edge of the trading band. Applying trade band projection methods gives a long-term target near $76. Achieving that target is hampered by the way the projected uptrend line now acts as a resistance level.

The second trend feature is shown with the Guppy Multiple Moving Average indicator. Despite the price retreat, the long-term group of averages is well separated, which shows strong and consistent investor support for a rising trend. When price retreats, then investors come into the market as buyers. This is the most consistent trend support behavior shown in the GMMA indicator on the oil chart in nearly a decade.

Compression in the group shows the development of a trend change and compression is currently not developing.

The degree of separation between the long-term and short-term GMMA is largely steady. The consistent degree of separation is a characteristic seen with stable trends, which again suggests that the current extended retreat is temporary rather than the beginning of a trend change.

The short-term group of averages reflects the way traders are thinking and its shows an appetite for short-term trade opportunities.

Those support features and the trend strength features all continue to suggest that the oil price is experiencing a temporary retreat. The longer-term trading band target is near $76, but it may take four or five months to achieve.

We use the ANTSYSS trade method to extract good returns from this trend behavior.

Daryl Guppy is a trader and author of Trend Trading, The 36 Strategies of the Chinese for Financial Traders, which can be found at www.guppytraders.com. He is a regular guest on CNBC Asia Squawk Box. He is a speaker at trading conferences in China, Asia, Australia and Europe. He is a special consultant to AxiCorp.

For more insight from CNBC contributors, follow @CNBCopinion on Twitter.

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

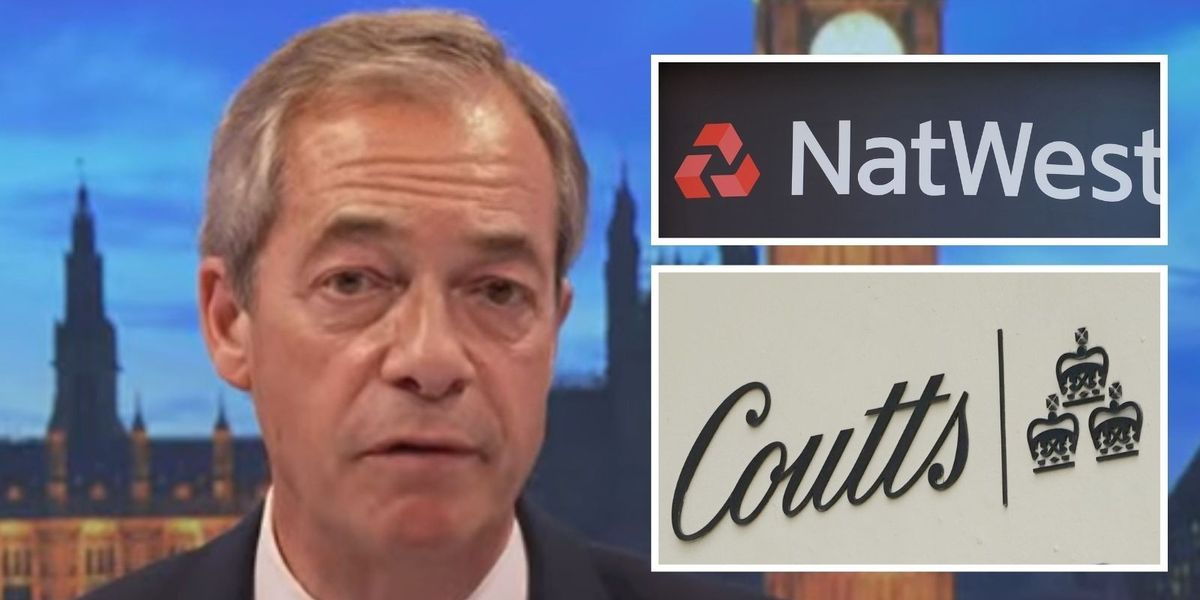

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession