Santander has announced a reduction to the interest rates on its line of mortgage products.

The lender has confirmed it has slashed all buy-to-let and selected residential mortgage rates by up to 0.16 per cent.

Last week, Santander cut interest rates across multiple fixed-rate products which benefited first-time homebuyers.

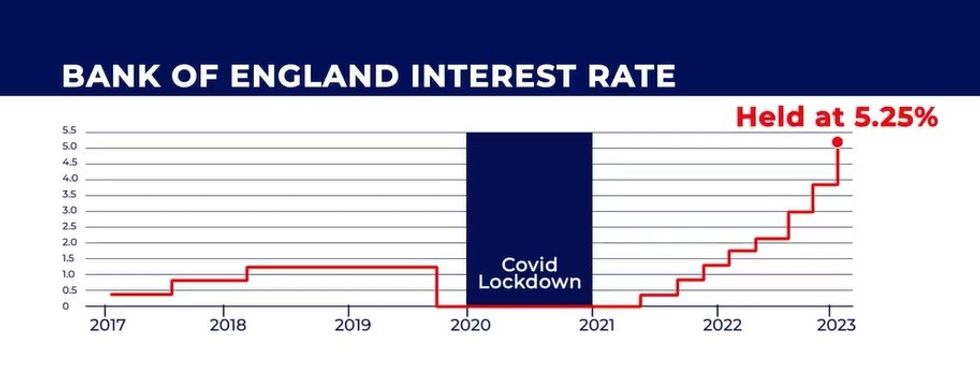

The Bank of England opted to hold the base rate at 5.25 per cent earlier this month, but signalled cuts could be coming later in the year.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Santander is cutting interest rates once again

GETTY

Following Santander’s latest update, the residential interest rate changes from the lender include:

Here are some examples of the buy-to-let products which have been reduced by Santander as of today:

The Bank of England has held the base rate at 5.25 per cent GB NEWS

The Bank of England has held the base rate at 5.25 per cent GB NEWS

Rachel Springall, a finance expert at Moneyfacts, highlighted that Britons will need to wait a bit longer before mortgage rates are cut more significantly.

She explained: “The recent observations made by the Bank of England would suggest base rate is unlikely to move for a few months yet, and indeed the Monetary Policy Committee will wait for firm evidence that inflation is under control before even considering a rate cut.

“Borrowers who are sitting on their Standard Variable Rate (SVR) should be incentivised to switch their mortgage if they can, as it’s unlikely they will see their repayments drop for the foreseeable.

“Indeed, the average two- and five-year fixed rates are much lower than the average SVR. Seeking advice from an independent broker is wise to work out if an individual could save a decent sum on their monthly repayments by changing their mortgage deal.”

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession