Savers are being urged “to consider” inflation-busting high interest accounts before high street banks and building societies remove them from the marketplace.

Savings interest rates have been on the rise over the past year following the Bank of England’s consecutive hikes to the base rate.

Earlier today, the Office for National Statistics (ONS) confirmed that the Consumer Price Index (CPI) inflation rate for January 2024 remained at four per cent for the second month in a row, meaning there are still inflation-beating options available.

In recent weeks, financial institutions such as Nationwide have begun to reduce the interest rates of popular savings accounts as the market prices in potential cuts to the base rate later in the year.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savings interest rates are still continuing to beat inflation despite recent cuts

GETTY

According to Moneyfactscompare, here are the best savings account on the market today for deals at £10,000 gross:

Here are the best ISA accounts on the market today for deals at £10,000 gross, based on Moneyfactscompare’s research:

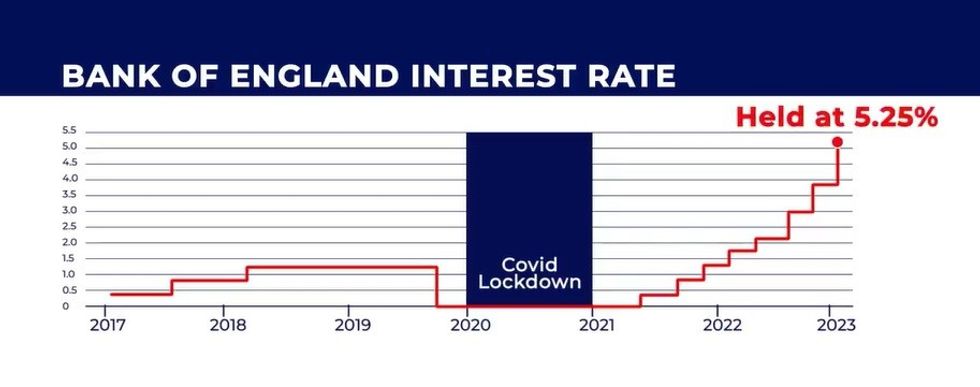

The Bank of England has held the base rate at 5.25 per cent since August 2023 GB NEWS

The Bank of England has held the base rate at 5.25 per cent since August 2023 GB NEWS

Rachel Springall, the finance expert at Moneyfactscompare.co.uk, said there are many favourable savings interest rates for Britons “to consider” despite recent rate reductions.

She explained: “Savers who prefer to lock their cash into a fixed rate bond or ISA for a guaranteed return will find more than half of the savings market can beat inflation, but they may be disappointed to see the top fixed rates have tumbled over the past month.

“Providers have been particularly active in this space due to the ongoing uncertainties surrounding future rate expectations.

“Challenger banks which sit towards the top end of the fixed bond market have had to adjust their market positions and will likely keep a close eye on their margins compared to their peers in the coming weeks.”

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

Latest Posts

Nigel Farage threatens NatWest with court proceedings to resolve debanking scandal

Amazon delivery driver ‘desperate’ for toilet smashed head on into car

Ricky Norwood set for ITV Dancing on Ice axe as dance expert exposes worrying ‘narrowing down’ trend

HMRC to give hundreds of thousands of households a £300 tax-free payment from today

The culpability for this recession must surely lie with the Bank of England

BBC The Apprentice viewers slam ‘awkward editing’ as contestant cut from spin-off show

BBC to air Steve Wright’s final Top of The Pops appearance amid backlash for treatment of late star

I point the finger of blame far more at the Bank of England than the government on recession